MRPL posts steady growth in Q4 despite pandemic inducted business pressures

The 15MMTPA Capacity MRPL Refinery at Kuthethur

The global epidemic has impacted the bottom lines of Mangalore Refinery and Petrochemicals Limited (MRPL), a subsidiary company of ONGC. At the company’s 236th meeting held on May 17, wherein the board of directors approved standalone and consolidated audited financial results for the fourth quarter (Q4 FY 21) and year ended (FY 21) March 31, the company reported steady growth in key result areas in Q4.

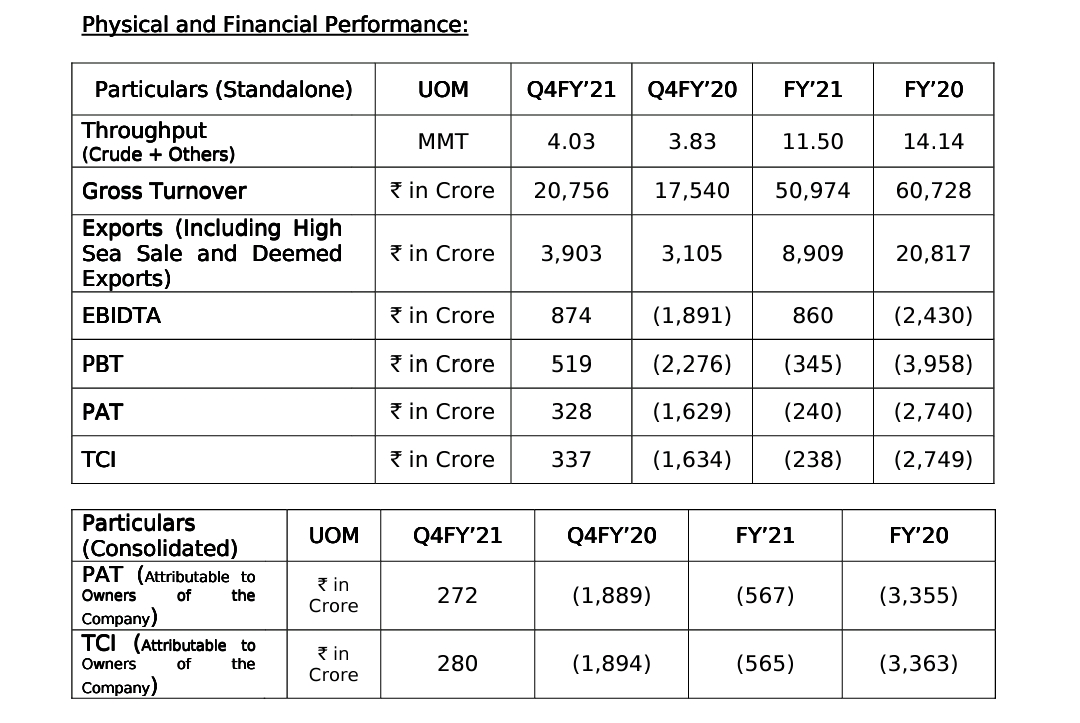

For the fourth quarter, gross revenue from operations was Rs 20,788 crore (Q4 FY 20 Rs 17,545 crore); profit before tax (PBT) stood at Rs 519 crore (Q4 FY 20 loss before tax Rs 2,276 crore); profit after tax (PAT) of Rs 328 crore (Q4 FY’20 loss after tax Rs1,629 crore) and gross refining margin was 6.50$/bbl (Q4 FY’20 GRM negative 4.52 $/bbl), the Kuthethur based only refiner for Karnataka announced.

In the financial highlights for FY 21; MRPLs gross revenue from operations stood at Rs 51,019 crore (FY 20 Rs 60,752 crore); loss before tax was Rs 345 crore (FY 20 loss before tax Rs 3,958 Crore); loss after tax of Rs 240 crore (FY 20 loss after tax Rs 2,740 crore) and FRM of 3.71 $/bbl (FY 20 negative GRM 0.23 $/bbl). The outbreak of pandemic globally and resultant lockdown in many countries impacted the business of the company.

Consequently, lower demand for crude oil, petroleum and petrochemical products have impacted the prices and refining margin globally during the part of the year which has resulted in a reduction in sales. Capacity utilisation gradually improved subsequently. Management has assessed the potential impact of Covid19 based on the current circumstances and expects no significant impact on the continuity of operations.

This assessment is of the business on a long term basis/on the useful life of the assets/ on long term financial position, M Venkatesh, managing director, MRPL said. The scenario may however result in lower revenues and refinery throughput in the near future. Timely pre-monsoon showers saved MRPL major operational blushes. This has come as a major lifeline in that its plans to set up a desalination plant have not progressed as expected.

MARKETING INITIATIVES

On the marketing front, MRPL has taken many initiatives to improve the revenue available from marketing margins. Domestic sales of petroleum products have increased by entering into new agreements with oil marketing companies. To capture retail margins, MRPL is focused on setting up its own retail outlets and the same is being expedited. The focus of setting up retail outlets is in Karnataka and adjoining Kerala.

This post has been published in arrangement with Jaideep J Shenoy